Pains, Claims, and Automobiles

Insurance data released earlier this year paints a clear picture as to why Louisiana car insurance rates are so high – insurance companies pay out twice the national average in bodily injury claims.

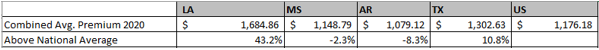

When it comes to the politics of auto insurance in Louisiana, the only point of consensus across the state is that the average rate is far too high. Based on data released in January by the National Association of Insurance Commissioners (NAIC)1, in 2020 the combined average premium in Louisiana was not only about $500 more than the national average, but well above every state around as well.

Premiums far above the national average – particularly in a state whose median household income is significantly below the national average – puts many residents in a financially precarious place. To try and lower our car insurance rates, we first want to determine why our rates are so excessive. An analysis of the NAIC report cited above made it clear that Louisiana is an outlier in several ways.

Claims and losses

The report breaks automotive claims and dollars paid out for the prior year into two categories, bodily injury and property. Bodily injury claims cover things like medical bills and lost wages owed to third parties by the policyholder, or the policyholder’s legal fees. Property claims and losses are those related to damage to a vehicle or other property in an auto accident.

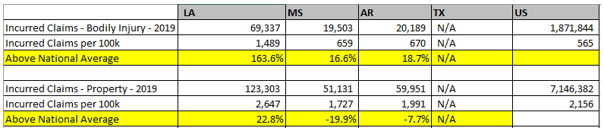

While Louisiana makes more property claims to their car insurers than the national average, the eye-popping outlier is the number of excess bodily injury claims. Louisiana residents are over two and a half times more likely to make a bodily injury rate than the national average, and one and a half times more likely than our neighbors2. This exponentially higher volume of bodily loss claims led to payouts well in excess of the national average and our neighboring states.

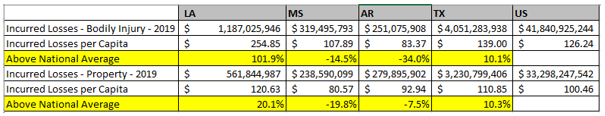

Insurance companies paid out the equivalent of $255 for every single man, woman, and child in the state last year in bodily injury claims alone. To put the $1.2 billion of bodily injury losses in 2019 in context, that’s nearly four times what the state awarded in TOPS scholarship dollars for 2019-2020.

Based on this data, insurers spend twice as much per capita on bodily injury claims here as they do nationally, and even more than that compared to Arkansas and Mississippi – two states with premiums below the national average. While Louisiana property losses are above the national average as well, the 20% excess dollars of loss versus the national average is dwarfed by the 102% excess dollars of loss in bodily injury. The simplest way to lower automotive insurance rates is to lower the number of bodily injury claims and the associated dollars of loss.

Why so many claims?

There are two main reasons Louisiana may have so many bodily injury claims: 1) if we actually have 2.5 times as many people injured in auto accidents per capita compared to the national average, Mississippi, and Arkansas; or 2) if we have insurance or legal systems that incentivize filing insurance bodily injury claims.

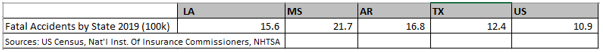

The former argument would posit that there are 2.5 times as many claims because there are that many more accidents in Louisiana. Claims data from the NAIC report does show that Louisiana has about 23% more automotive property claims than the national average, which implies there are more cars in accidents. However, the 23% in excess property claims is a drop in the bucket compared to the number of excess bodily injury claims, which are 164% above the national average. In addition, other accident data suggests two of our neighboring states are more dangerous to drive in, not less.

Mississippi had about 40% more traffic fatalities per capita than Louisiana, and Arkansas was above the state as well. Yet Mississippi only had $107.89 in bodily injury losses per capita that year, compared to $254.85 for Louisiana, despite the significantly higher incidence of fatal crashes. There is little evidence to suggest it’s 2.5 times more dangerous to drive in Louisiana than Arkansas or Mississippi, so it is unlikely to be the main cause of our excessive bodily injury claims.

This suggests that Louisiana presently has a system that encourages significantly more bodily injury claims than our peer states and the country as a whole. Until we lower the number of bodily injury claims and losses, we will continue to have exceedingly high auto insurance rates – effectively, our rates are higher because they are used to pay the excessive number of claims. Our peer states have lower rates because insurers have fewer claims and dollars to pay out per capita.

With a new Insurance Commissioner, Governor, and a new legislature, there is reason for hope that progress can finally be made on this financial millstone around the necks of Louisiana families. In 2020, the state legislature and governor compromised to pass only modest legal reforms aimed at reducing auto insurance rates. But based on how out-of-step Louisiana’s bodily injury auto insurance claims are compared to the national average, these half-measures are unlikely to be effective. Louisiana’s leaders need to act with vigilance on auto insurance on behalf of their residents and small business owners.

The state legislature and governor might want to consider some commonsense policy solutions, such as:

· Require reversionary trusts for damages paid for future medical expenses, to ensure the money goes to future medical expenses; and

· Allow insurers to pay medical expenses directly to ensure efficiency and remove third party expenses.

In addition to these, the state should enlist national experts in insurance law and economics to identify how Louisiana encourages bodily injury claims to a greater degree than our neighbors, and what changes will most effectively lower auto insurance rates.

All data regarding claims and loss is from the NAIC report linked in the text, which covers private passenger (non-commercial) auto policies. Per capita numbers were derived by using the 2020 US Census counts for each state.

While NAIC was able to collect dollar loss and rate information from Texas, claims data was not provided.