Tracking the Cost of Living in a Time of Big Inflation

Anecdotally, we’ve all noticed that a dollar doesn’t go as far as it used to. But how has inflation impacted the Capital Region compared to the rest of the country?

Although the pandemic continues to fade into the background of our national consciousness, the patterns and policies that we engaged in as a response continue to affect our everyday lives – hybrid work continues to be preferred by job seekers, lower labor force participation has created a tight labor market, and so on. Arguably, the shift that has affected people the most, has been the spike of inflation caused by stimulative government spending in response to COVID-19: recent polling shows that 63% of Americans say their income is falling behind the cost of living1; data backs this up, as year-over-year inflation was up 8.3% in August, while average hourly earnings fell 2.8%2. Turning to the local economy, we thought it was important to look into how this crucial issue is impacting the Capital Region in particular.

Looking Into Cost of Living

Each quarter, economic researchers across the country at organizations like BRAC collect data related to grocery prices, housing costs, restaurant prices and more, which is then sent to a group called the Council for Community and Economic Research (C2ER). C2ER then aggregates the data to come up with a national average costs for all the items and categories, and determines the cost of living for each participating metro area compared to the national average, which is indexed at 100.0 – this means an area scoring 98.0 is 2% less expensive than the national average, and 102.0 is 2% more expensive.

The map below provides a visual illustration of data we pulled from C2ER’s report for the second quarter of this year, with some peer-sized metros’ scores.

As one may expect, the metro areas closer to or on the east coast are more expensive than their midwestern and southeastern peers – although New Orleans stands out as an exception that we’ll address later. While this data is interesting on its own, since it has been published quarterly for years, we can use it to determine how each region has been impacted by inflation.

Cost of Living: Then Versus Now

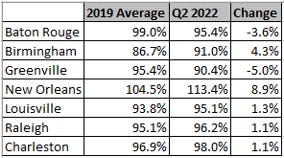

As the table below illustrates, the cost of living for a number of Baton Rouge’s peer metro areas has shifted from their pre-pandemic scores. While Birmingham was 13.3% less expensive than the national average in 2019, they’re now only 9.0% below – still low, but a significant 4.3% increase compared to the national average3. That’s an important distinction to make – that 4.3% isn’t an average increase in price, but an increase in the costs of goods and services in Birmingham compared to the national average, indicating that inflation has hit Birmingham worse than the national average.

This means that the closer a 2022 number is to its 2019 number, the more in-line that region is with the average national impact of inflation. Based on that, Baton Rouge and Greenville appear to have weathered inflation better than any other peer metro. For Baton Rouge, pre-pandemic it was only 1.0% less expensive than the national average; now, it’s 4.6% less expensive, meaning that while goods and services have increased in price here, they have done so to a lesser extent than the rest of the country. On the flip side, the five other metro areas appear to have been more heavily impacted by inflation than the national average, as their scores are closer to 100.0 or have increased well above.

What Causes the Variations?

While there are many potential causes for one metro area to be more impacted than another in terms of inflation – supply chain and local regulations, for example – housing sticks out as a major factor. Based on the cost-of-living formula, housing prices are nearly a third of what determines a region’s score. Nationally, some metrics show an increase in national housing prices of nearly 41% from March 2020 to June 20224. It stands to reason that areas that saw the greatest increase in housing prices were most impacted by inflation, while areas with more stable housing prices saw their cost-of-living scores fall.

The data from C2ER lends some credence to this idea. The two metros that saw a decrease in their indexed scores compared to the national average had housing prices that either fell (Birmingham, 8.8% lower housing prices) or remained stable at a low cost (Baton Rouge, 0.6% increase and 21.5% below the national average) relative to the national average. The metro that saw the largest housing price increase (New Orleans, 20.8% increase) also saw the largest overall cost-of-living increase of 8.9%.

What it All Means

To reiterate, while Baton Rouge appears to have weathered the inflationary storm better than many of our peers and the nation overall, that doesn’t mean our residents have been inoculated from inflationary pain. This same data set used above shows that orange juice is 6.8% more expensive in Baton Rouge than at the outset of the pandemic, and ground beef is up a whopping 20.0%. Homes are more expensive to purchase, and mortgages have higher interest rates.

However, the Capital Region’s lower cost of living relative to the rest of the country is important from both a perception and talent attraction standpoint. In November 2021, BRAC commissioned a national perception study, which surveyed over 1,500 respondents living in major US metro areas. Data showed that 67% of business professionals under 45 years old viewed Baton Rouge’s reasonable cost of living as a favorable feature. More specifically, the phrase “housing prices in Baton Rouge are significantly lower than the national average” had more positive impact than any other message tested on young professionals in every single market. While we acutely note that the costs of goods and services are going up for current Capital Region residents, our increasingly reasonable cost of living compared to the average US city remains an asset as we look to compete nationally for talent.

Bureau of Labor Statistics, Consumer Price Index and Real Earnings Summary, September 13, 2022.

Council for Community and Economic Research, Cost of Living Index, 2019 Annual Report and 2022 Second Quarter Report; BRAC Analysis.

S&P/Case-Shiller U.S. National Home Price Index; BRAC Analysis.